The price of tin is2022In the first quarter of the year, the overall trend of tin prices continued to shift upward. This was mainly due to the fact that, against the backdrop of the global "dual carbon" goals and the strong willingness to expand production due to the global chip shortage, the market was unanimously optimistic about the prospects of tin, and the weighted price of tin in Shanghai rose in the first quarter52156yuan/Tons, with a cumulative increase of17.82%. Against the current backdrop, the market is unanimously optimistic about the prospects of tin.

2After the Spring Festival, many enterprises extended their holidays, which led to a decline in the operating rate of smelters. Coupled with the outbreak of the epidemic in Jiangsu, Guangdong and other places, many manufacturers shut down or limited their factories. Therefore, both the supply and demand of tin were not high.

3Due to the impact of nickel shorting the global market in the month, Shanghai Tin experienced significant fluctuations and returned to a reasonable fundamental range with narrow fluctuations in the last week.

From the perspectives of supply and demand, the supply elasticity of tin is very low, but the demand is very high, which leads to an imbalance between the supply and demand of tin as a whole. It is difficult to achieve an effective improvement in the short term, and the cost of tin accounts for a relatively small proportion for most terminals. All these provide a strong support for the tin price to remain at a high level.

Tin is inherently a commodity that is prone to rise but hard to fall. Since20Since the beginning of this year, the price center of tin in Shanghai has been constantly rising. There is no sign of a decrease in the demand for tin at various terminals, and the expected new increase this year is very little. Recently, local governments have frequently issued documents on accelerating photovoltaic construction or plans. The price of tin may continue to rise in the second quarter. However, it is worth noting that the current domestic epidemic situation is recurring, and the shortage of rare gases caused by the Russia-Ukraine conflict abroad has affected the chip operating rate. The demand may fall short of expectations, posing some risks.

At present, domestic and international inventories are in a differentiated state. The inventory of LME tin has declined, while that of Shanghai tin has slightly increased. The tight supply situation still exists. The spot market maintains a high premium, and the fundamentals remain strong. It is expected that the tin price will fluctuate at a high level.

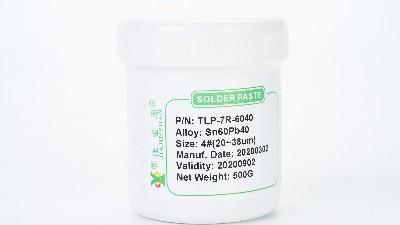

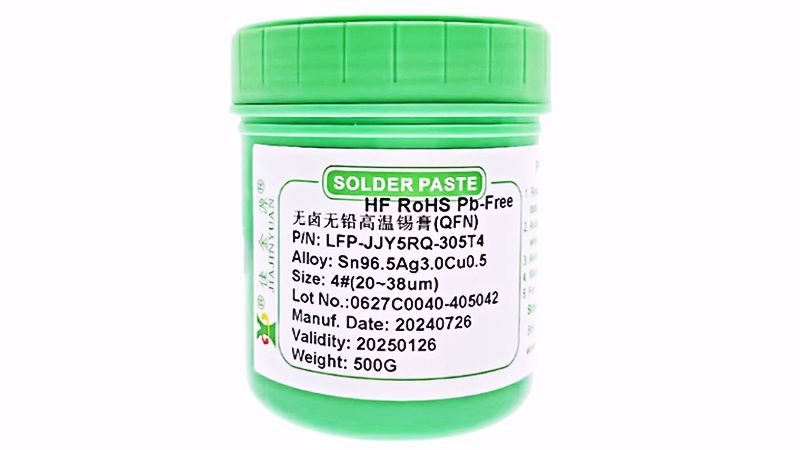

The above is an introduction to some specific content for you. If you want to know more, welcome to keep following JJYSolder paste manufacturerLeave a message online to interact with us.

Tel:+86 0755 88366766

Tel:+86 0755 88366766 Phone:+86 18938660310

Phone:+86 18938660310 Email:sales@jjyhanxi.com

Email:sales@jjyhanxi.com Address:13/F,12/F, Building No. B,Qinghu Technology Park,Qingxiang Rd.,Qinghu Community, Longhua Subdistrict,Longhua District,Shenzhen City,GUANGDONG Province,P.R.C.(518027)

Address:13/F,12/F, Building No. B,Qinghu Technology Park,Qingxiang Rd.,Qinghu Community, Longhua Subdistrict,Longhua District,Shenzhen City,GUANGDONG Province,P.R.C.(518027) Guangdong Public Security Backup 44030902002666 name

Guangdong Public Security Backup 44030902002666 name

WeChat

WeChat WeChat official account

WeChat official account